At first the term tax haven designated countries offering attractive low-tax regimes to attract financial services. Menerapkan tarif pajak rendah atau 0.

Tax Havens Cost Governments 200 Billion A Year It S Time To Change The Way Global Tax Works World Economic Forum

Tax Havens Cost Governments 200 Billion A Year It S Time To Change The Way Global Tax Works World Economic Forum

EU list of tax havens Taxation and Customs Union 12 jurisdictions 13 jurisdictions Black list Annex I Grey list Annex II 18 February 2020 Anguilla Australia Bosnia and Herzegovina Botswana Eswatini Jordan Maldives Morocco Mongolia Namibia Saint Lucia Thailand and Turkey American Samoa Cayman Islands Fiji Guam Palau Panama Samoa.

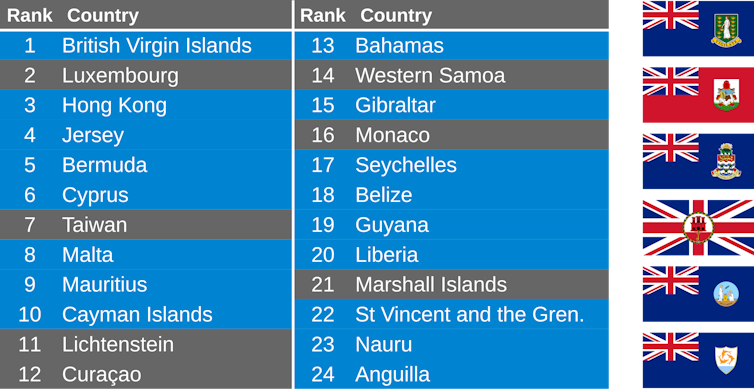

Tax haven countries. Tidak adanya persyaratan aktivitas substansial bagi perusahaan. These tax havens still have the ability to enable tax treaties closer to zero like traditional tax havens by using base erosion and profit shifting tools BEPS. The top ten tax havens in the world are.

Menurut Tax Justice Network sebuah organisasi independen yang menganalisa aturan keuangan dan pajak internasional membuat daftar 10 besar negara yang sangat ketat dalam aturan kerahasiaan. Tax havens include countries such as Andorra Antigua and Barbuda the Bahamas Cayman Islands British Virgin Islands Monaco Isle of Man Guernsey Samoa Bermuda Cyprus Gibraltar Dominica Belize Panama and Vanuatu. A list of some of the most popular tax haven countries includes Andorra the Bahamas Belize Bermuda the British Virgin Islands the Cayman Islands the Channel Islands the Cook Islands The.

66 rows Basically any country can be a tax haven if the conditions are right for a person or company. This being said modern corporate tax havens have high levels of OECD-compliance and have bilateral tax treaties. Most of the top tax havens are island nations like the British Virgin Islands Samoa and Malta.

Masih dalam report yang sama OECD juga menetapkan 4 kriteria untuk mengkategorikan bahwa suatu negara tergolong sebagai tax haven countries yaitu. Tidak adanya transparansi dalam pemungutan pajak. Tidak adanya pertukaran informasi.

Oxfam named Bermuda the worlds worst corporate tax haven in 2016 and it was one of 30 countries blacklisted as a tax haven by the EU in 2015. Later it was used to describe jurisdictions that do not respect the tax good governance principles vis-à-vis other jurisdictions since their objective is to attract tax bases or investment.

Eu Tax Haven Blacklist Finance Ministers Remove Eight Countries Including Panama News Dw 23 01 2018

Eu Tax Haven Blacklist Finance Ministers Remove Eight Countries Including Panama News Dw 23 01 2018

Where Are The Worst Tax Havens In The World Oxfam Australia

Where Are The Worst Tax Havens In The World Oxfam Australia

List Of Companies With Subsidiaries In Tax Haven Countries Download Table

List Of Companies With Subsidiaries In Tax Haven Countries Download Table

These Ten Worst Corporate Tax Havens In The World Are Stifling Sustainable Development Un Dispatch

These Ten Worst Corporate Tax Havens In The World Are Stifling Sustainable Development Un Dispatch

Eu Takes Panama Seven Others Off Tax Haven List European Data News Hub

Eu Takes Panama Seven Others Off Tax Haven List European Data News Hub

Taxing The Untaxed Vi What Are Tax Havens And Why They Matter To India

Taxing The Untaxed Vi What Are Tax Havens And Why They Matter To India

Amar No Country For Income Tax

Top Tax Haven Countries Choices Offshorecorptalk

Europe Home To 6 Of The Globe S Top 10 Tax Havens Ireland Tops List

Europe Home To 6 Of The Globe S Top 10 Tax Havens Ireland Tops List

Corporate Tax Haven Index 2019 Global Alliance For Tax Justice

Corporate Tax Haven Index 2019 Global Alliance For Tax Justice

Watershed Data Indicates More Than A Trillion Dollars Of Corporate Profit Smuggled Into Tax Havens

Watershed Data Indicates More Than A Trillion Dollars Of Corporate Profit Smuggled Into Tax Havens

These Five Countries Are Conduits For The World S Biggest Tax Havens

These Five Countries Are Conduits For The World S Biggest Tax Havens

Which U S Companies Have The Most Tax Havens Infographic

Which U S Companies Have The Most Tax Havens Infographic

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.