Since then commodity investments have moved to the forefront of the alternative asset class agenda as asset managers pension funds insurance companies and other institutional investors seek. Ad Search 4400 Hedge Funds Including Full Contact Details AUM and More.

Commodity Hedge Funds Riding Soaring Gold Prices See More Gains To Come Financial News

Commodity Hedge Funds Riding Soaring Gold Prices See More Gains To Come Financial News

Commodities The Hedge Fund Journal.

Commodity hedge funds. The Barclays Capital Equity Gilt Study 2004 included an analysis of commodities as an asset class for the first time. The Andurand Commodities Discretionary Enhanced strategy rose a spectacular 1541 per cent in the same period. Ad 46000000 Register users 178 Countries Supported and over 1800000 Active Investors.

Vanguards year-old Commodity Strategy a mutual fund has a low expense ratio of. 300 Assets to Invest Wide Range of Lucrative Assets. All in all the fund provides investors with diversified commodities exposure and a portfolio hedge against inflation.

Commodities Broad Basket Broad Basket portfolios can invest in a diversified basket of commodity goods including but not limited to grains minerals metals livestock cotton oils sugar coffee. There is no doubt in my mind that the people who were running all of those hedge funds that had to shut down were very high IQ individuals. These funds invest in precious metals such as gold and silver energy resources such as oil and natural gas and agricultural goods such as wheat.

They were smart likely too smart. Commodity Funds That Hold Futures Holding commodity-linked derivative instruments is a much more common mutual fund strategy for investing in the. Ad 46000000 Register users 178 Countries Supported and over 1800000 Active Investors.

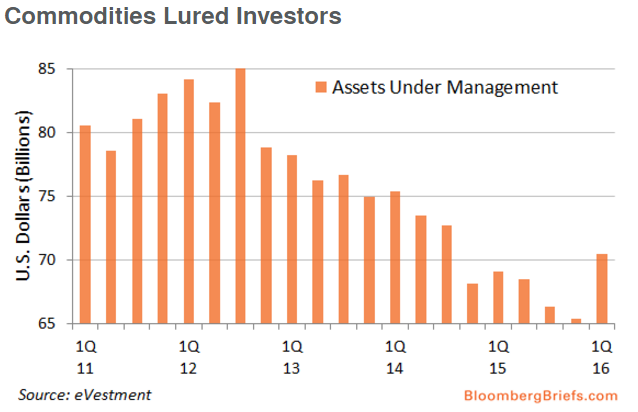

Of the 368 commodity hedge funds that were in business in March 2012 only 130 remain. Commodity futures exchanges were originally created to enable producers and buyers of commodities to hedge against their long or short cash positions in commodities. Australian firm Tribeca Investment Partners Switzerland-based Montreux Capital Management and Canada-based Front Street Capital managed three of the most high-performing hedge funds globally in.

Citadels flagship Wellington fund which practices a multi-strategy array of investments on stocks bonds commodities and other securities using teams of. 300 Assets to Invest Wide Range of Lucrative Assets. Three firms betting on the commodities markets have topped a ranking of the worlds best-performing hedge funds last year with returns in excess of 130.

The Andurand Commodities Fund the main strategy of high-profile oil hedge fund manager Pierre Andurand surged 68 per cent last year a strong return to form for the fund after suffering annual losses in recent years. A hurdle rate is applied in about 15 per cent of cases. The average commodity hedge fund charges a 2 per cent management fee and a supplementary 20 per cent performance fee which is subject to a high watermark in 80 per cent of all cases.

Commodity funds invest in raw materials or primary agricultural products known as commodities. Commodity Funds and ETFs invest in a broad basket of commodities and natural resources including precious metals energy and agricultural goods. The Bridge Alternatives Commodity Hedge Fund Index is designed as a benchmark to track the performance of the largest commodity-focused hedge funds.

Index performance is reported on a monthly basis and includes the. Even though traders and other speculators represent the bulk of trading volume on futures exchanges hedgers are their true reason for being. Care should be taken when assessing hedging securities to ensure.

It uses a sophisticated formula to maximize the yield of its portfolio and. Some funds have indirect costs via the derivatives they use. To find out detailed information on Commodity in the US click the.

Commodity options are an alternative to futures that can be used for hedging. Ad Search 4400 Hedge Funds Including Full Contact Details AUM and More. It is the first commodity hedge fund index to be transparent and to give an accurate representation of where assets are allocated within the commodity hedge fund space.

Most of those 130 are operating with greatly reduced portfolio sizes. Commodity funds may also invest in the companies that produce these commodities.

Investors Rush To Commodities Hedge Funds Seeking Alpha

Investors Rush To Commodities Hedge Funds Seeking Alpha

Charts Hedge Funds Turn Commodity Bears At Record Pace Mining Com

Charts Hedge Funds Turn Commodity Bears At Record Pace Mining Com

Hedge Funds Extend Strong Start To The Year Led By Ctamanaged Futures Funds As Commodity Prices Rise Opalesque

Hedge Funds Extend Strong Start To The Year Led By Ctamanaged Futures Funds As Commodity Prices Rise Opalesque

Commodities Trading Booms As New Strategy Emerges By Gregory Meyer Customer Self Service

Commodities Trading Booms As New Strategy Emerges By Gregory Meyer Customer Self Service

Oil Hedge Funds Struggle In Age Of Algos Wsj

Oil Hedge Funds Struggle In Age Of Algos Wsj

Benefits Of Cta And Managed Futures Hedge Funds Tyton Capital Advisors

Benefits Of Cta And Managed Futures Hedge Funds Tyton Capital Advisors

Last Commodities Hedge Funds Go Off Beaten Track Financial Times

What Are Crypto Hedge Funds The European Business Review

What Are Crypto Hedge Funds The European Business Review

Star Commodity Hedge Fund Lost 51 In 2019 Bnn Bloomberg

Long Short Commodity Investment For Diversified Portfolios The Hedge Fund Journal

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.